64% of Americans don’t know what a 529 plan is.85% of eligible investors don’t make catch-up...

Why the Timing of Financial Advice Matters Just as Much as the Advice Itself

Encouraging clients to take action toward certain financial goals can be difficult to do. But advisors who consider the timing of the advice delivery tend to have more success.

Why is that?

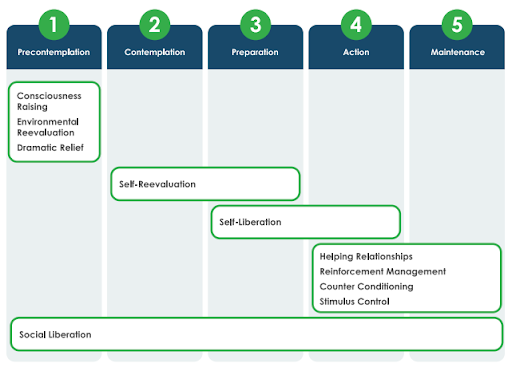

Knowing when to engage with clients has a lot to do with the Transtheoretical Model of Change. This psychological concept is a framework that organizes behavior change and provides insights into the support people need at each stage to encourage change.

Each of the five stages of the Transtheoretical Model of Change includes key interventions that can encourage a client to move from one stage to the next.

The five stages of the Transtheoretical Model of Change and the key interventions are outlined below.

So what does this have to do with encouraging action toward financial goals?

Advisors that identify what stage of change their clients are currently in and can deliver advice in a way that helps them move to the next stage will not only help them achieve their goals, but will earn their trust and more referrals as well.

For example, let’s look at a couple who is nearing retirement age. With a complex financial situation as they approach the age to begin collecting Social Security Benefits, their financial advisor wants to start the conversation. But what’s the best time to broach the subject?

This couple is in the “preparation phase” as outlined in the model above. Since they don’t need to make any major changes right now–but are getting close–the advisor may question the best time to deliver timely advice. The advisor may not know what to include in a message.

While answering these questions is difficult, understanding the importance of advice timing is critical to having more breakthrough moments with clients.

Want to read more about the importance of the timing of advice? Download our whitepaper on the subject now.

.png)

.png)